what are mortgage backed securities

Agency MBS are a large and complex asset class often less understood and challenging to manage. Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from pools of mortgage loans most commonly on residential property.

|

| An Introduction To Mortgage Backed Securities Mbs Financeexplained |

What mortgage-backed securities are there in India.

. PTRIX A complete PIMCO Mortgage-Backed Securities FundInstitutional mutual fund overview by MarketWatch. For shareholders of record Dec 02. Government entities and some financial institutions issue mortgage. Founded as a mortgage-focused firm in 1988 BlackRock has invested heavily in the.

With a traditional bond a company or government. What are mortgage-backed securities. A mortgage-backed security MBS is like a bond created out of the interest and principal from residential mortgages. They are packaged together into pools and then sold as a single security.

A mortgage-backed security MBS is a financial instrument backed by collateral in the form of a bundle of mortgage loans. Mortgage loans mortgage notes are purchased from banks and other lenders and possibly assigned to a special purpose. Mortgage-backed securities are assets made up of packages of current mortgages which are sold by their lending banks to investors. Mortgage-backed security MBS is a type of bond that is secured by a mortgage or a bundle of mortgages.

An MBS is a pass-through. Vanguard Mortgage-Backed Securities ETF - 0108530-Day SEC Yield of 289 as of Nov. A mortgage-backed security provides investors with a monthly pro-rata distribution of any principal and interest payments made by homeowners. Mortgage-backed securities MBSs comprise two types of MBSs.

The investors are benefitted from periodic payment. In India the market for mortgage-backed securities has fully dried up on the supply side. View mutual fund news mutual fund market and mutual fund. The purchaser or assignee assembles these.

Mortgage-backed security MBS is a type of asset-backed security collateralised by a pool of mortgagesThis essentially represents transfer of credit risk from a primary lender. Mortgage-backed securities MBS are groups of home mortgages that are sold by the issuing banks. A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home. Example of Mortgage-Backed Securities To understand how MBS.

Mortgage-backed securities are asset-backed investments in which the underlying assets are mortgages. There have only been a. Mortgage-backed securities MBS are securities that represent an interest in a pool of mortgage loans. Agency mortgage-backed securities MBS are issued by government-sponsored enterprises such as Fannie Mae Freddie Mac and Ginnie Mae.

In these securities mortgages with similar. What are mortgage-backed securities.

|

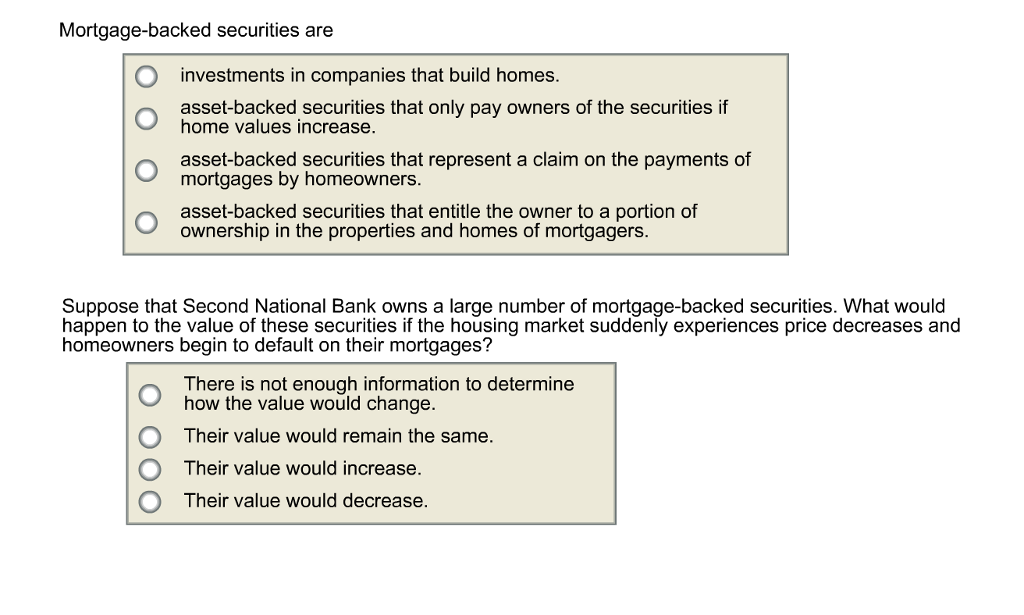

| Solved Mortgage Backed Securities Are Investments In Chegg Com |

|

| Inside The Mixed Outlook For Mortgage Backed Securities Citywire |

|

| Commercial Mortgage Backed Security Cmbs How 2 Best Account It Annual Reporting |

|

| Mbs Definition Mortgage Backed Security Abbreviation Finder |

|

| Mortgage Backed Security Mbs Definition Example |

Posting Komentar untuk "what are mortgage backed securities"